Nova Scotia Archives

Poll Tax Records 1791-1795

1793 Amendment to the Poll Tax Act

published in the Royal Gazette and the Nova Scotia Advertiser May 21, 1793

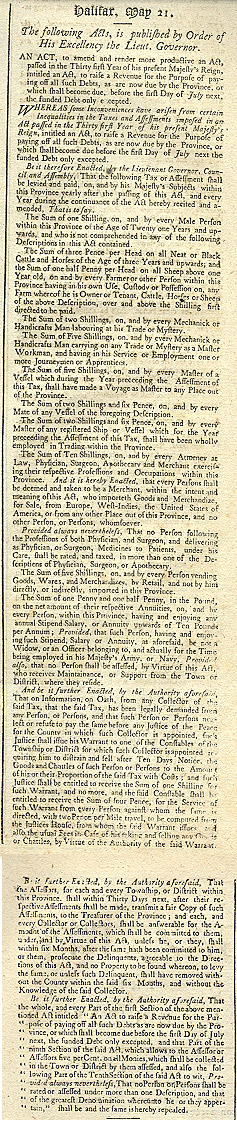

Halifax, May 21

——

The following Acts is published by Order of His Excellency the Lieut. Governor.

AN ACT, to amend and render more productive an Act, passed in, the Thirty first Year of his present Majesty's Reign, intitled an Act, to raise a Revenue for the Purpose of paying off all such Debts, as are now due by the Province, or which shall become due, before the first Day of July next, the funded Debt only excepted.

WHEREAS some Inconveniences have arisen from certain Inequalities in the Taxes and Assessments imposed in an Act passed in the Thirty first Year of his present Majesty's Reign, intitled an Act, to raise a Revenue for the Purpose of paying such Debts, as are now due by the Province, or which shall become due before the first Day of July next the funded Debt only excepted.

Be it therefore Enacted, by the Lieutenant Governor, Council and Assembly, That the following Tax or Assessment shall be levied and paid, on, and by his Majesty's Subjects within this Province yearly after the passing of this Act, and every Year during the continuance of the Act hereby recited and amended, That is to say.

The sum of one shilling, on, and by every Male Person within this Province of the Age of Twenty one Years and upwards, and who is not comprehended in any of the following Descriptions in this Act contained.

The sum of three Pence per head on all Neat or Black Cattle and Horses of the Age of three Years and upwards; and the Sum of one half Penny per Head on all Sheep above one Year old, on and by every Farmer or other Person within this Province having in his own Use, Custody or Possession on, any Farm whereof he is Owner or Tenant, Cattle, Horses or Sheep or the above Description, over and above the Shilling first directed to be paid.

The Sum of two Shillings, on, and by every Mechanick or Handicrafts Man labouring at his Trade or Mystery.

The Sum of Five Shillings, on, and by every Mechanick or Handicrafts Man carrying on any Trade or Mystery as a Master Workman, and having in his Service or Employment one or more Journeymen or Apprentices.

The Sum of five Shillings, on, and by every Master of a Vessel which during the Year preceeding the Assessment of this Tax, shall have made a Voyage as Master to any Place out of the Province.

The Sum of two Shillings and six Pence, 1 on, and by every Mate of any Vessel of the foregoing Description. The Sum of two Shillings and six Pence, on, and by every Master of any registered Ship or Vessel which for the Year preceeding the Assessment of this Tax, shall have been wholly employed in Trading within the Province.

The Sum of Ten Shillings, on, and by every Attorney Surgeon, Apothecary and Merchant exercising their respective Professions and Occupations within this Province. And it is hereby Enacted, that every Persons shall be deemed and taken to be a Merchant, within the intent and meaning of this Act, who importeth Goods and merchandize, for Sale, from Europe, West-Indies, the United States of America or from any other Place out of this Province, and no other Person, or Persons, whomsoever.

Provided always nevertheless, That no Person following the Professions of both Physician, and Surgeon, and delivering as Physician, or Surgeon, Medicines to Patients, under his Care, shall be rated, and taxed, in more than one of the Descriptions of Physician, Surgeon, or Apothecary.

The Sum of five Shillings, on, and by every Person vending Goods, Wares, and Merchandizes, by Retail, and not by him directly, or indirectly, imported in this Province. The Sum of one Penny and one half Penny, in the Pound, on the net-amount of their respective Annuties, on, and by every Person, within this Province, having and enjoying any annual' Stipend Salary, or Annuity upwards to Ten Pounds per Annum; Provided, that such Person, having and enjoying such Stipend, Salary or Annuity, as aforesaid, be not a Widow, or an Officer belonging to, and actually for the Time being employed in his Majesty's Army, or Navy, Provided also,. that no Person shall be assessed, by Virtue of this Act, who receives Maintenance, or Support from the Town or District, where they reside.

And be it further Enacted, by the Authority aforesaid, That on Information, on Oath, from any Collector of the said Tax, that the said Tax, has been legally demanded from any Person, or Persons, and that such Person or Persons neglect or refuse to pay the same before any Justice or the Peace for the County in which such Collector is appointed, such Justice shall issue his Warrant to one of the Constables of the Township or District for which such Collector is appointed, requiring him to distrain and sell after Ten Days Notice, the Goods and Chattles of such Person or Persons to the Amount of his or their Proportion of the said Tax with Costs: and such Justice shall be entitled to receive the Sum of one Shilling for such Warrant, and no more, and the said Constable shall be entitled to receive the Sum of four Pence, for the Service of such Warrant from every Person against whom the came is directed, with two Pence per Mile travel, to be computed from the Justices House, from whom the said Warrant Issues and also the usual Fees in Case of his taking and selling any Goods or Chattles, by Virtue of the Authority of the said Warrant.

Be it Further Enacted, by the Authority aforesaid, That the Assessors, for each and every Township, or District within this Province, shall within Thirty Days next, after their respective Assessments shall be made, transmit a fair Copy of such Assessments, to the Treasurer of the Province; and each, and every Collector or Collectors, shall be answerable for the Amount of the Assessments, which shall be committed to them, under, and by Virtue of this Act, unless he, or they, shall within six Months, after the same hath been committed to him, or them, prosecute the Delinquents, agreeable to the Directions of this Act, and no Property to be found whereon, to levy the same, or unless such Deliquent, shall have removed without the Country within the said six Months, and without the Knowledge of the said Collector.

Be it further Enacted, by the Authority aforesaid, That the whole, and every Part of the first Section of the above mentioned Act intitled "An Act to raise a Revenue for the Purpose of paying off all such Debts as are now due by the Province, or which shall become due before the first Day of July next, the funded Debt only excepted, and that Part of the ninth Section of the said Act, which allows to the Assessor or Assessors five perCent, on all Monies, which shall be collected in the Town of District by them assessed, and also the following Part of the Tenth Section of the said Act to wit, Provided always nevertheless, That no Person or Persons shall be rated or assessed under more than one Description, and that of the greatest Denomination whereunto he or they appertain", shall be and the same is hereby repealed.

——